John Westermann

Commercial Real Estate Consultant

6 PPG Place, #500

Pittsburgh, PA 15222

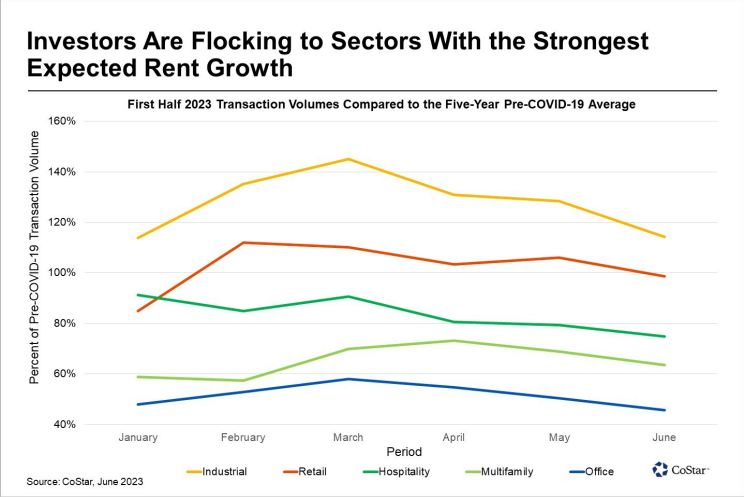

At the Midpoint of 2023, Multifamily and Office Lag Behind Industrial and Retail Property

Transaction volume for the five major commercial real estate asset types is projected to crest at about $200 billion, a 24% decline compared to the six-month average of $265 billion for the five years before the advent of COVID-19, based on preliminary mid-year estimates for the first half of 2023.

The significant decline in overall property sales reflects the broader macro-economic environment characterized by much higher interest rates, which have reached their highest level since 2007. At the same time, economic uncertainty, slowing rent gains and a wide bid-ask spread have been felt across all property types. More than any other measure of financial engineering, however, confidence in future rent growth is the key metric that drives property sale transactions.

At the midway point of 2023, industrial property is leading the pack in terms of relative transaction volume, with cumulative sales reaching 114% of the average of the five years before COVID-19 through the first six months of the year. This strong performance can be attributed to the dependable growth of cash flows and the relatively smooth access to credit across various lenders. Participants in this sector highlight the impressive year-over-year rent growth of 8% in the second quarter of 2023, which is nearly double the growth rate of other commercial property sectors.

Retail properties are also experiencing robust rent growth, with strip centers seeing a 4.2% year-over-year average increase at this time. The turnover in this sector is currently on par with its long-term tendencies. Additionally, a large pool of all-cash buyers has helped to mitigate the impact of price declines from rising interest rates, which is driving additional capital into the sector.

The hospitality segment follows suit, with the average daily rate, or ADR, growth expected to fall from the high single digits to 3.8% year over year by December 2023. Notably, despite strong recent rent growth, concerns about hotels' connection to the office sector and consumer spending may further reduce annualized rent growth in 2024. As a result, hotels are trading at 75% of their historical pace over the first half of this year.

The multifamily segment, once a hotbed for transaction volumes, has experienced a notable decline due to a continuous influx of new completions and higher borrowing costs. Mid-year sales projections indicate that the popular asset type is selling at just 63% of its previous volume. Nevertheless, access to debt through government-sponsored enterprises, or GSE, and government agencies is still available, helping to support deal flow.

The office sector, trading at just 46% of its pre-pandemic levels, faces the greatest challenges surrounding future cash flows, which is limiting interest from lenders. Average rent growth in the office sector is already below 1% year over year and is expected to be negative by the end of the year. While some investors may view this asset class as untouchable, others perceive opportunity amid the growing uncertainty and discounting.

Lenders and investment committees remain eager to deploy capital despite the downward trend in total sales activity. The challenge lies in balancing cash flow appreciation to keep pace with inflation with capital preservation, considering the historically high basis that will be locked in at current entry points. While opportunities may vary across geographies and sectors, the market is dynamic and penetrable. By approaching investment and lending decisions with cash flow durability in mind, capital allocators can uncover innovative methods to remain active.

QUICK LINKS

CONTACT

John Westermann, Advisor

SVN | Three Rivers Commercial Advisors

6 PPG Place, #500

Pittsburgh, PA 15222

412.535.8060

©2018 SVN International Corp. All Rights Reserved. SVN and the SVN COMMERCIAL REAL ESTATE ADVISORS Logos are registered service marks of SVN International Corp.

The information presented here is deemed to be accurate, but it has not been independently verified. We make no guarantee, warranty or representation. It is your responsibility to independently confirm accuracy and completeness.

All SVN® offices are independently owned and operated.

Created by McRales: Marketing simplified.