John Westermann

Commercial Real Estate Consultant

6 PPG Place, #500

Pittsburgh, PA 15222

Remote work and e-commerce are reducing demand for office and retail space

Commercial real estate has experienced its share of busts in recent decades. This one is different.

Landlords are contending simultaneously with a cyclical market downturn and with secular changes in the way people work, live and shop. The sudden surge in interest rates caused property values to fall, while the rise of remote work and e-commerce are reducing demand for office and retail space.

Investors and economists say these two forces haven’t come together on this scale since the 1970s, when a recession followed surging oil prices and a stock-market rout while new technologies enabled jobs to move out of major cities. This time, the pandemic is largely responsible for accelerating the commercial property upheaval.

The U.S. office vacancy rate reached a milestone in the first quarter when it rose to 12.9%, exceeding the peak vacancy rate during the 2008 financial crisis. Despite low unemployment, that figure marked the highest vacancy rate since data firm CoStar Group Inc. began tracking it in 2000.

It is unknown how bad the commercial property downturn will get. Some analysts say it may well end up less severe than the previous two downturns, in the early 1990s and after the 2008 financial crisis, especially if the U.S. economy avoids a deep recession and interest rates start to come down quickly.

But the deeper problems facing office and certain retail landlords mean building values are less likely to rebound to new highs the way they did after those previous meltdowns.

That, in turn, suggests that commercial real estate won’t contribute as much to the country’s economic growth as it had during previous rebounds. Depressed building values could hurt cities, which depend on property-tax revenue, and weigh on bank balance sheets, leading to less lending throughout the economy.

It is also bad news for the banks, pension funds and asset managers that are among the biggest lenders to and owners of commercial buildings, which means they could face losses for years to come. Commercial mortgages account for around 38% of the median U.S. bank’s loan holdings, according to KBW Research. North American public pension funds on average hold around 9% of their assets in real estate, according to Preqin.

“You literally have trillions of dollars of investment that are suddenly just massively impaired,” said Dan Zwirn, chief executive of Arena Investors, a New York-based asset manager and real-estate investor.

During previous downturns, fundamental trends usually worked in property owners’ favor once the economy showed signs of rebounding. Increasingly white-collar workers crowded into cities, filling office towers and ensuring a reliable stream of customers at shops and restaurants. Meanwhile, red tape and zoning restrictions made it harder for developers to build, protecting property owners from competition.

That helped building values bounce back and reach record highs after the crisis was over. Since these property market routs coincided with economic slumps, the Federal Reserve cut interest rates to lower borrowing costs and boost the economy. Between late 1993 and mid-2022, U.S. commercial real-estate prices grew almost fourfold, according to MSCI Real Assets, easily outpacing inflation.

Now, new technologies and changes in the way people live and work are threatening many landlords, said Ben Miller, CEO of property investment firm Fundrise. Retail owners for years have grappled with the rise of e-commerce, which has pushed down the value of storefronts and is still a threat to shopping malls throughout the country.

Store closures increased significantly this year, said UBS Group AG, which estimated this month that around 50,000 retail stores in the U.S. will close over the next five years. Bed Bath & Beyond Inc. became the latest major chain retailer to falter when it filed for bankruptcy protection on Sunday after years of losses and failed turnaround plans. The company said it expects to close all of its 360 Bed Bath & Beyond and 120 Buybuy Baby retail locations eventually.

Office owners are at the beginning of the process of working off their glut and could face many years of falling tenant demand. The growing popularity of remote work, made possible by technologies like email, Zoom and Dropbox, means offices are far emptier than they were before the pandemic. The occupied space per office worker is 12% below where it was in 2015, CoStar said, a sign that corporate tenants may want less space when they renew office leases.

“People thought of these office buildings as forever, because of course it’s going to be 98% leased forever,” Mr. Zwirn said. “People were not planning on this secular change.”

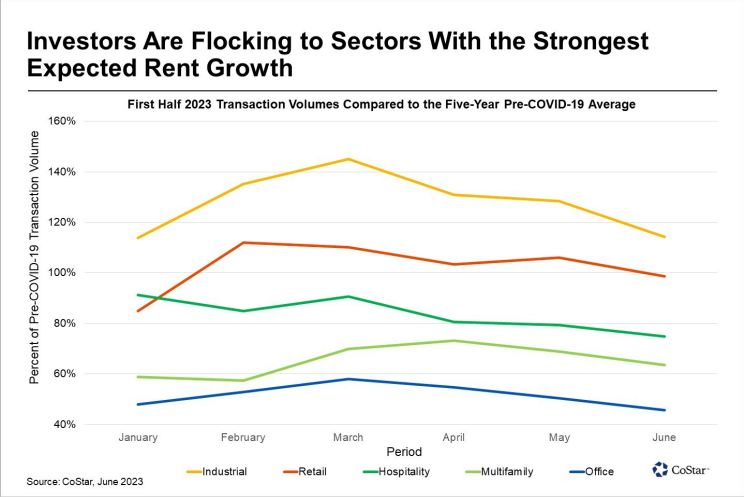

Not all commercial real estate looks imperiled. Data centers and warehouses have benefited from ecommerce and remote work. Apartment rents are well above prepandemic levels and most analysts expect the country’s housing shortage to persist, which supports higher rents. Retail rents are rising again in Manhattan, while some major chain stores are expanding after years of store closures.

Even for the beleaguered office market, there are some mitigating factors. Landlords mostly hold less debt as a share of property values than they did in 2008.

Still, most analysts expect vacancies to keep rising as more leases expire and companies cut back on space. Office-building prices are down 25% since early 2022, estimates real-estate analytics firm Green Street. Prices of malls are down 19% since early 2022 and down 44% since 2016.

The last time landlords in big U.S. cities suffered market downturns alongside a secular shift was in the 1960s and 1970s, said Jim Costello, chief economist at MSCI Real Assets. The spread of highways, fax machines and cheap long-distance calls allowed factories and offices to move from big cities to cheaper places, he said. More families ditched urban centers for the suburbs. Inflation and rising unemployment took a toll.

Many owners of urban apartments, offices and retail space saw their wealth wiped out. In the Bronx, some landlords set fire to their properties to collect insurance money.

This time, vacancies and rising interest rates are coming together to hit office owners. Take the Meridian at Deerwood Park, a sprawling office complex in suburban Jacksonville, Fla. The property’s sole tenant, Deutsche Bank, moved out in late 2022, according to data from Trepp Inc.

With debt costs surging and building values plummeting across the U.S., the owner didn’t get a new loan and defaulted on the property’s mortgage when it expired on April 1, according to Trepp.

https://www.wsj.com/articles/commercial-real-estate-woes-run-deeper-than-in-past-downturns-e0c1f2b3

QUICK LINKS

CONTACT

John Westermann, Advisor

SVN | Three Rivers Commercial Advisors

6 PPG Place, #500

Pittsburgh, PA 15222

412.535.8060

©2018 SVN International Corp. All Rights Reserved. SVN and the SVN COMMERCIAL REAL ESTATE ADVISORS Logos are registered service marks of SVN International Corp.

The information presented here is deemed to be accurate, but it has not been independently verified. We make no guarantee, warranty or representation. It is your responsibility to independently confirm accuracy and completeness.

All SVN® offices are independently owned and operated.

Created by McRales: Marketing simplified.